Dec 25, 2022

Overcoming Fear in Investing

Emotions are a big part of our lives. Most of us aspire to have some sort of happiness in life, and happiness is definitely an emotion we would like to feel more regularly. In contrast to happiness, fear is an emotion we tend to avoid. Is fear then a bad thing? Perhaps not, if we consider how, for example, the fear of being knocked down may help us cross the road carefully. However, if the fear prevents us from crossing the road at all, then it is not so healthy. This highlights the importance of emotional management – to allow our fears to move us in taking the right actions in life and not be paralysed from doing what is right.

Are emotions even relevant in investing?

Emotional management seems like a more relevant topic for a relational subject like parenting. So, what has it got to do with investing? For most people, investing is a subject that harnesses the intellect – poring through pages of financial analysis. While that is an accurate image, it is an incomplete one. Think about taking a roller coaster ride. An engineer with the intelligence of Albert Einstein may be able to design the safest roller coaster on earth, but whether he would find the courage to take it would be another matter altogether. Hence, when facing the volatile nature of investments, an investor needs both a strong mind and a strong heart.

How does fear impact investing?

Our previous article, Instead of Timing the Market, Choose to Stay in It, highlights the dangers of market timing. While investors time the market for various reasons, a key reason is fear – usually the fear of missing out. The Wall Street legend, Stanley Druckenmiller, once lost $3 billion in a matter of 6 weeks1. Known for producing an average return of 30% per year for many years for his hedge fund and considered as one of the greatest investor of all time, Stanley Druckenmiller lost $3 billion during the dot-com bubble with a single phone call. He had steered clear of speculative stocks for a very long time, only to cave in at the very tail end of the bubble. As accomplished as he was in investing, he was not spared from bad investment choices resulting from fear.

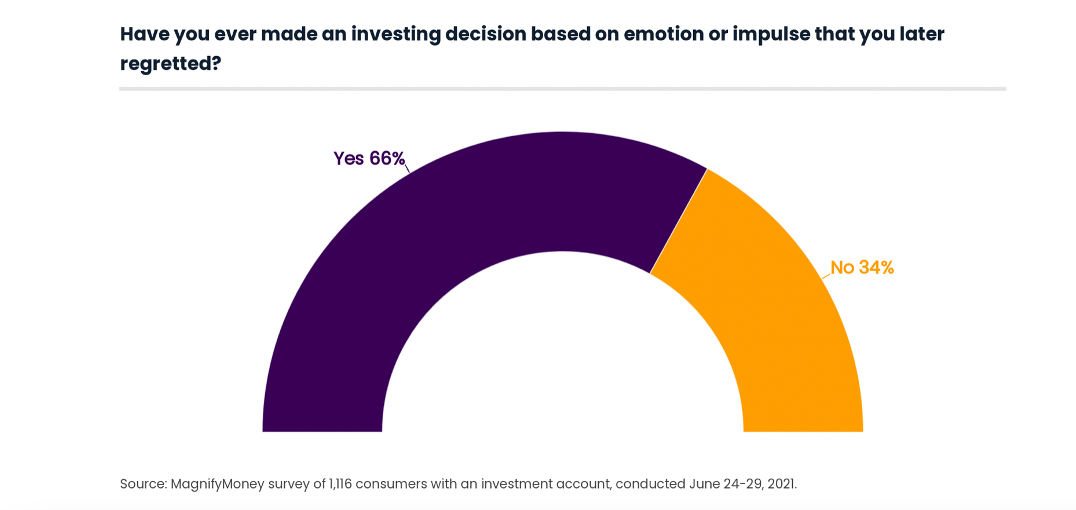

A recent survey conducted by MagnifyMoney reported that 66% of investors made an impulsive or emotionally charged decision they later regretted. 58% of the surveyed agreed that their portfolios would perform better if emotions were left out of the equation, but that is easier said than done. Nearly half (47%) indicated difficulties keeping emotions out of investing decisions2.

The survey also reported other interesting observations – such as the notably higher percentage of Gen Zers and Millennials who regretted the above-mentioned emotional investing.

How do we avoid emotional investing, and invest successfully?

Emotions are indeed a big and inseparable part of our lives, because human beings are both rational and emotional creatures. Hence, while it is possible, it is difficult to keep our emotions in check while investing. Nevertheless, it is important not to jump to the other extreme of not investing at all. Take for example, another survey, the OCBC Financial Wellness Index survey in 2021 – it reported that the majority of working adults in Singapore are financially unprepared for retirement, and one in three said that they do not invest and see investing as a form of gambling3. As the stock markets continue to correct themselves, individuals with such a mindset risk missing out on a great opportunity to grow their wealth and stay ahead of the swelling inflation. How then can investors stay invested without getting overwhelmed by the fear that comes with falling stock prices?

According to Investment Guru Warren Buffett, when interviewed during a period of wild market fluctuations, he told investors: “Don’t watch the market closely3”. His intention was to prevent investors from being fearful about the fluctuations and end up buying or selling on impulse. An easy way to invest ‘without watching the market closely’ would be to create a system, using a strategy like dollar cost averaging (DCA). Think about how effortless it is, for example, to brush our teeth. This is because it has become our daily habit – most people can brush their teeth on autopilot. Thus, among many other benefits, DCA can help investors invest in a systematic and emotionally managed way. It is effective because the investor keeps investing without any pressure to constantly analyse price movements.

Dollar cost averaging will also calm the nerves of the investor. How so? Have you ever looked down from the top of a long escalator and felt dizzy? Or felt overwhelmed while burning the midnight oil for a major exam? Compare that to descending via a series of shorter escalators or studying more consistently for regular quizzes. Any big and daunting issue in life often feels more manageable when it is broken down to smaller bits. The stress involved in investing a percentage of your income on a monthly basis most certainly differs from investing a sizeable portion of your total assets at one go. This is what DCA can do for you and your emotions. (For the strategic advantage of DCA in capturing good investment opportunities, see our previous article).

Conclusion

With a very bullish market in 2021 spiralling downwards this year, and a very gloomy economic outlook for 2023, how do you feel about the new year? Can it truly be a happy new year? For the investor who has a clear mindset and strategy for growing wealth in volatile times, it will be a truly exciting time. This is what we are confident in providing with Unicorn, and we encourage you to keep growing your monthly investments. We wish you a Merry Christmas and Happy New Year, as we partner you in your wealth-building journey for yet another year.

Sources:

1.TheStreet

2.MagnifyMoney

3.Business Times

4.CNBC

5.Images from MagnifyMoney

Important Notice

The information herein is published by Unicorn Financial Solutions Pte. Limited. (“Unicorn”) and is for information only. This publication is intended for Unicorn and its clients or prospective clients to whom it has been delivered and may not be reproduced or transmitted to any other person without the prior permission of Unicorn. The information and opinions contained in this publication has been obtained from sources believed to be reliable, but Unicorn does not make any representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose. Opinions and estimates are subject to change without notice. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment. Unicorn accepts no liability whatsoever for any direct indirect or consequential losses or damages arising from or in connection with the use or reliance of this publication or its contents. The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. Unicorn does not accept liability for any errors or omissions in the contents of this publication, which may arise as a result of electronic transmission. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Unicorn Financial Solutions Pte. Limited Reg. No.: 200501540R